Does this requirement apply to partnerships that use software approved for electronic filing for a portion of their return but develop their own software to prepare other portions of the income tax return?Ī6. Partnerships that choose to develop their own tax preparation software must have the software approved by IRS. If you choose to develop your own software, it must be approved by the IRS before it can be used to file an electronic return. You will be required to purchase software approved for electronic filing, develop your own software or use an IRS Authorized e-file Provider to prepare your electronic return. What if a partnership prepares the income tax return “in-house” but does not use tax preparation software?Ī5.

Partnerships that purchase tax preparation software and prepare their own income tax return should discuss the various electronic filing options with their software vendor as soon as possible. Taxpayers should check with their tax preparer early to ensure they are ready to file your electronic income tax return.

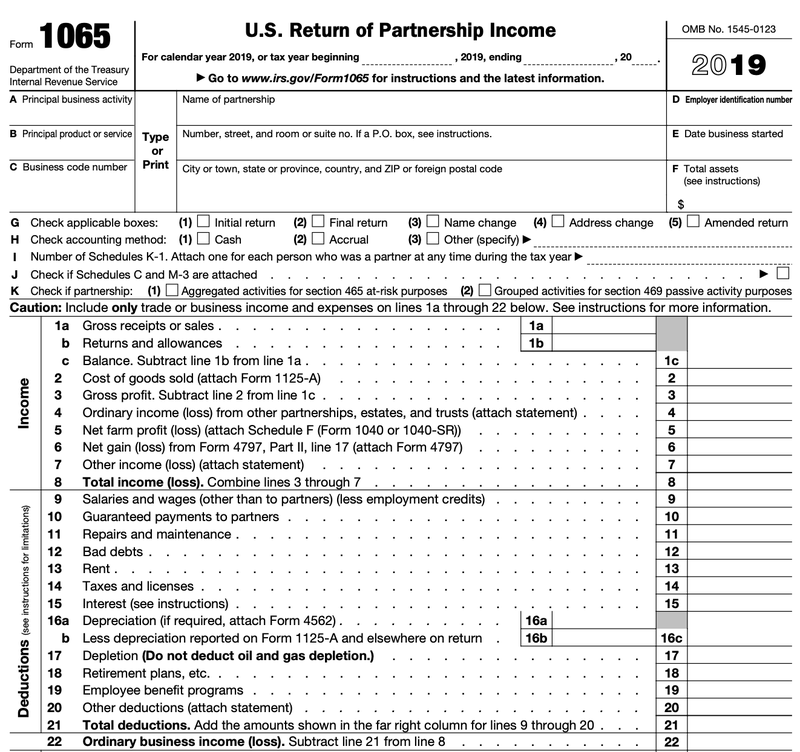

#1065 tax preparation professional

The partnership’s tax professional will need to use software approved for electronic filing and also be an IRS Authorized e-file Provider. If the partnership uses a tax professional to prepare the income tax return, it does not need special software to file electronically. The answer depends on if the partnership uses a tax professional to prepare their income tax return or if the partnership prepares their own income tax return. Does a partnership need special software to file an electronic income tax return?Ī4. For purposes of electronic filing, the IRS defines a “Large Taxpayer” as a business or other entity with assets of $10 million or more, or a partnership with more than 100 partners, which originates the electronic submission of its own return(s). What is the IRS’s definition of a “Large Taxpayer”?Ī3. Forms 7004, and the 94X family are not required to be e-filed. No, the requirement to e-file applies only to the Form 1065 or 1065-B. If the partnership is required to e-file their Form 1065 or 1065-B, are they also required to e-file their extension and employment tax returns?Ī2. Partnerships with 100 or less partners (Schedules K-1) may voluntarily file their return using the MeF Platform. This law became effective for partnership returns with taxable years ending on or after December 31, 2000. Section 1224, of the Taxpayer Relief Act of 1997, requires partnerships with more than 100 partners (Schedules K-1) to file their return on magnetic media (electronically as prescribed by the IRS Commissioner). Which partnerships are required to file returns electronically?Ī1.

0 kommentar(er)

0 kommentar(er)